Solutions Tailored to You

Bespoke investment strategies aligned to whatever your financial objectives may be. Our clients gain access to a sophisticated open-architecture

platform of traditional and alternative investments across all major asset classes in addition to select private investment opportunities.

Wealth Strategy

As an extension of your team, we review your full financial picture, and connect you to the firm’s broader resources to create an unbroken chain of objective, holistic and relevant advice.

- Wealth Advisory

- Estate Planning

- Insurance Advisory

- Tax Planning

- Philanthropy

- Wealth Transfer

Family Office Solutions

Led by your private advisor, your dedicated team can help with everything from managing day-to-day finances to creating and implementing a financial plan designed to grow with you on every step of your wealth journey.

- Bill Concierge

- Tax Preparation and Filing

- Bespoke Financial Reporting

- Human Capital Services

- Foundation Administration

- High Touch Comprehensive Advisory Services

Strategic Client Solutions

A comprehensive suite of solutions for holistic financial planning – for individuals and institutions.

- Banking and Lending Services

- Retirement Plan Products and Services

- Insurance and Annuity Solutions

Trustee Services

Our comprehensive services cater to various trusts, including dynasty trusts, annual exclusion gift trusts, and revocable trusts. We offer general fiduciary oversight, day-to-day account management, comprehensive account reviews with our expert team, as well as assistance with implementing distributions and bill-pay services.

- Sole Trustee

- Successor Trustee

- Co-Trustee

- Agent for Trustee

- Directed and Administrative Trustee

Philanthropic Advisory

We think not only about your needs for today and tomorrow, but about your passions and the life you want to lead, and the legacy you want to leave behind for yourself and your family.

- Charitable Planning

- Donor Advised Funds vs. Private Foundations

- Multigenerational Engagement

Lifestyle Advisory

Through our curated Rockefeller Lifestyle Advisory partners, we provide our clients with access to exclusive experiences, and concierge services so you can focus on the people and passions that matter most to you.

- Once in a Lifetime Experiences

- Unique Travel Experiences

- Purpose-Driven Wine Platform

- Cyber Security

- Private Health Advisory

- Personal Security

- Virtual Specialty Care

- Elder Care

- Emergency Travel Services

- Next Gen and Career Transition Advisory

- Art Advisory

- Private Aviation

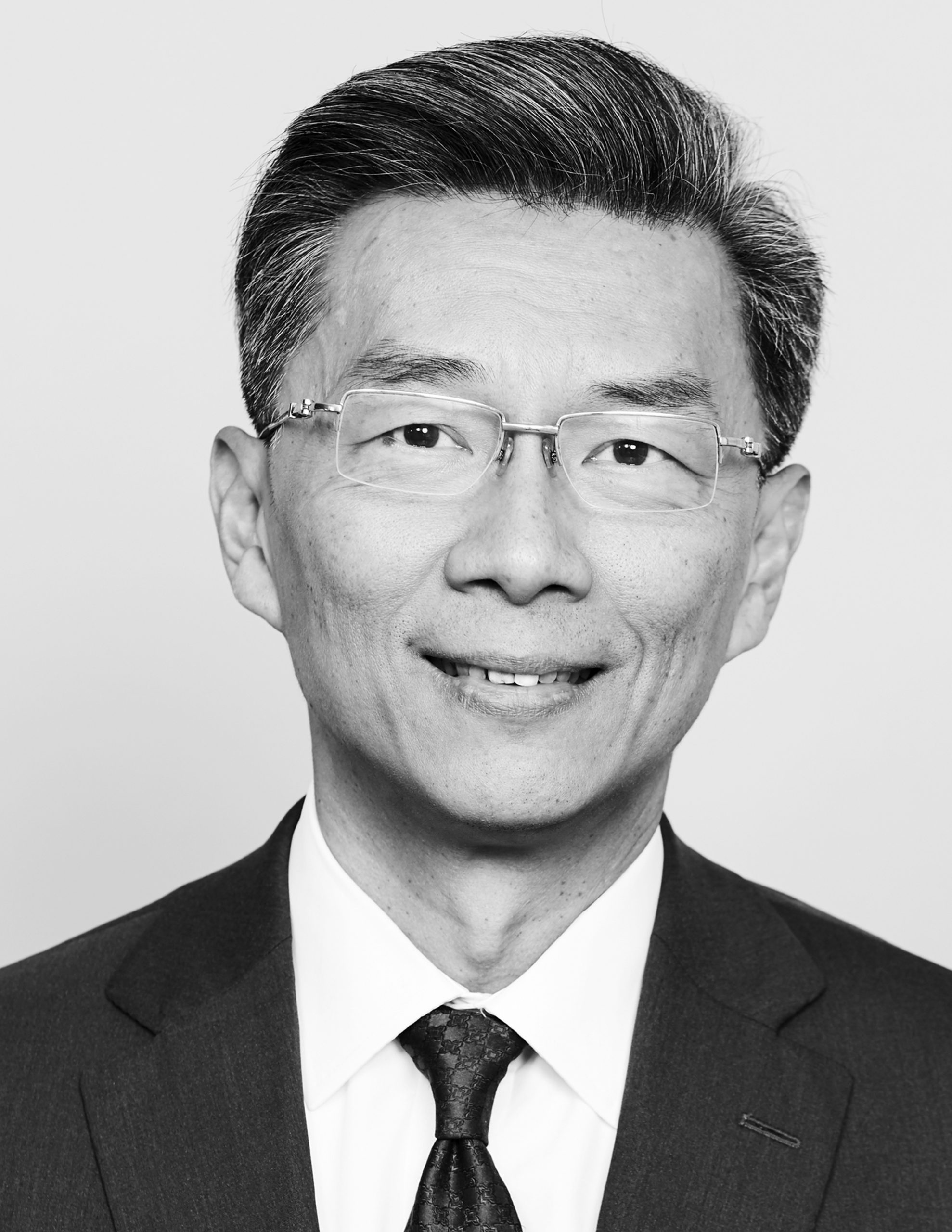

Meet Our Team

At The Atlantic Group our team builds relationships based on trust and transparency. We take time to curate wealth management solutions that are customized, flexible, and built specifically to our clients' individual needs and objectives.