TAKING THE LONG VIEW

In search of excellence; long market cycles

The recently deceased satirist, P.J. O’Rourke, once said, “Hubris is one of the great renewable resources.” From Chairman Xi’s stubborn zero-COVID tolerance to Prime Minister Trudeau’s invocation of the Emergencies Act to crush a non-violent protest against his vaccine mandate, there is no shortage of overreaches by alpha-male politicians. However, Vladimir Putin, a kleptocrat who fancies himself as the modern-day Peter the Great, showed how hubris can lead to not only irrational but also deadly decisions. Ironically, Putin’s colossal miscalculations have suddenly transformed himself from a feared “strategic thinker” with all the leverage to an internationally despised pariah who may someday stand trial for war crimes. Vlad the Mad never imagined that he could be outmatched by the courageous Ukrainian President Zelenskyy, who has exhibited a Churchillian resolve in inspiring the Ukrainian people to defend their independence. Putin has also unwittingly united the often-fractious Western alliance to impose some hitherto unfathomable sanctions – e.g., freezing the Russian central bank’s overseas assets – that will inflict serious damage on the Russian economy and his war machine.

However, a brutal dictator with his back against the wall could be even more irrational and dangerous. Depending on what happens to Russia’s internal politics, i.e., Putin’s grip on power, there could be a wide range of potential outcomes from a protracted Cold War with Russia and China on the same side, to a great reset in Eurasia akin to the collapse of the Soviet Union. The West, especially Europe, would also be hurt by fallouts from the sanctions in the near term. The central banks’ policymaking is becoming more complicated as the odds of stagflation have risen – inflation is likely to be stickier due to disruptions to Russian and Ukrainian exports, while aggregate demand may finally succumb to higher prices.

In short, we are in the midst of a historic geopolitical realignment and the situation remains fluid. The Ukrainian people’s bravery in their darkest hours has given me hope that they may have set in motion the eventual downfall of dictators in Moscow, Minsk, and various other capitals eastward, which would be a bullish long-term development. However, I am realistic enough to realize that these dictators could defy gravity for a while in the new Cold War. The elevated geopolitical uncertainty, a potentially stagflationary environment, and more complicated monetary policy responses may continue to weigh on the market. They also beg the question of whether or not the easy money driven secular bull market since 2009 is now facing existential threats. Nothing is set in stone as so many things are still in flux these days. For now, investors are well-advised to focus on quality, and to be patient and opportunistic rather than being swayed by the fear of missing out as was the case during the last couple of years.

IN SEARCH OF EXCELLENCE

The early 1980s was a tumultuous time for America. The country was beset by two recessions and geopolitical challenges. These problems were aptly captured by TIME Magazine’s covers from forty years ago (click here for the images). The February 8, 1982 issue featured the silhouette of a man with a droopy head and the caption, “UNEMPLOYMENT, The Biggest Worry.” The March 8th issue showed a cigar-smoking Fed Chair Volcker with the headline, “Interest Rate Anguish.” The March 20th cover was apocalyptic: “THINKING THE UNTHINKABLE, Rising Fears About Nuclear War.” The market’s ephemeral optimism over Reagan’s electoral victory in 1980 had given way to despondency as the S&P 500 Index was steadily trending downward with lower-highs and lower-lows from the post-election high reached on November 9, 1980.

Despite the general sense of malaise, TIME did pick up some green shoots. A picture of Steve Jobs with a red apple on his head adorned the cover of the February 15th issue; its caption read, “STRIKING IT RICH, America’s Risk Takers.” An expectant Jaclyn Smith of Charlie’s Angels fame graced the cover of the following issue. The cover story, “The New Baby Bloom,” was about career women opting for pregnancy and the country’s rising birth rate. The budding PC industry prompted the magazine to highlight “A New Breed of Whiz Kids” in the May 3rd issue. Indeed, a technology revolution was underway in 1982 with the founding of future industry titans such as Adobe, Autodesk, Compaq, Lotus Software, and Sun Microsystems.

While these geeky “whiz kids” were embracing personal computing, many American business executives were looking uneasily to the east – Japan Inc. was eating Corporate America’s lunch. It became fashionable for management consultants to study and preach Japanese management philosophies. The March 30, 1981 issue of TIME showed a samurai carrying gadgets such as a camera, watch, calculator, etc., and the cover story was titled, “How Japan Does It; The World’s Toughest Competitor.” William Ouchi’s 1981 book, Theory Z: How American Business Can Meet the Japanese Challenge, was a New York Times best-seller for over five months. It advised American executives to provide life-long employment like Japanese companies to inspire loyalty, better morale, and higher productivity among their workers.

In 1982, Tom Peters and Robert Waterman Jr published In Search of Excellence, a book that went against the prevailing Japanese management fad to focus instead on lessons from America’s best-run companies. According to Peters, In Search of Excellence started as a “marginal” project at McKinsey’s rather “offbeat” San Francisco office in 1977, when he rejoined the company after earning a PhD in Organizational Behavior at Stanford. He was asked to look at “organizational effectiveness” and “implementation issues.” Peters took advantage of the seemingly infinite travel budget and McKinsey’s gold-plated business card to fly around the world in first class to interview respected industry executives and academics.

In June 1980, Peters published an op-ed in the Wall Street Journal which stressed the importance of execution over strategy. The article immediately created a stir within McKinsey since the firm was known for helping clients develop strategies. The top brass of the firm demanded that Peters be fired. Sensing that he did not have much of a future at the company, Peters started working on an exit plan. Waterman helped Peters negotiate a separation package that included an even split of the upcoming book’s royalty between Peters and the firm; Waterman did not bother to ask for royalty since no one at McKinsey thought the book would be a big deal. Well, that turned out to be a giant underestimation.Upon completing his interview tour, Peters organized his findings and recommendations into a 700-page presentation with eight themes. With the help of Peters’ putative boss, Waterman, and two professors, the work evolved into the McKinsey 7S Framework, one of the most popular strategic planning tools for businesses. Their success led publisher Harper & Row to approach them about co-writing a book on management philosophies.

Upon its publication in 1982, In Search of Excellence was initially dismissed by America’s high priests of management philosophies in academia as a banality of anecdotes. However, the book’s profiles of 43 American companies that were doing things right struck a nerve with its readers. In Search of Excellence became one of the all-time best-selling management books and, ironically, made Tom Peters the most famous consultant that McKinsey has ever developed. Waterman regretted not asking for any royalties from the book, but he wound up getting several multi-million-dollar book deals anyway and founded his own successful consulting firm.

Coincidental with In Search of Excellence’s coverage of 43 “excellent” American companies, investors started looking at them as investment opportunities. On August 12th, the S&P 500 Index bottomed at the Reagan-era low of 102.42, a level it had first reached in September 1968. The Dow Jones Industrial Average Index finished the day at 777, which reflected a painful retracement of 18-years back to January 1964. On the following day, as if suddenly electrified by a bolt of lightning, investors started buying and major equity indices were pushed 20% higher in less than a month.

The nascent bull market prompted TIME to feature a bull wrapped in ticker tape on the cover of the September 6th issue. With the economy still mired in recession, the caption read, “WALL STREET, Olé! THE ECONOMY, Eh?” Against this backdrop of general misgivings, the so-called Reaganomics, started to work its magic. The U.S. emerged from the recession in December of 1982 and led the “Free World” to a new era of prosperity and to a victory over the Soviet bloc. The equity rally that started with little fanfare on August 13th, 1982 evolved into one of the greatest bull markets in history.

GOOD COMPANIES FOR THE LONG RUN

The business book genre is full of ill-timed publications. In 1986, Buck Rogers, a retired IBM marketing executive, published IBM Way: Insights into the World’s Most Successful Marketing Organization, just when the company was slipping into a downward spiral that would eventually require outsiders (e.g., Lou Gerstner Jr) to turn it around with tough surgeries and medicines. In 1995, David Packard, the legendary co-founder of Hewlett-Packard, wrote The HP Way: How Bill Hewlett and I Built Our Company. Four years later, HP’s board of directors brought in Carly Fiorina to shake up the company’s culture. Fiorina wound up rocking so many boats that the dysfunctional board forced her to resign in 2005. General Electric was one of the most celebrated American companies feted with numerous books and articles about the “GE Way.” Jack Welch & The G.E. Way: Management Insights and Leadership Secrets of the Legendary CEO was published in 1998; Jeff Immelt and the New GE Way: Innovation, Transformation and Winning in the 21st Century came out in March 2009, when the world was mired in the Great Financial Crisis. Ironically, it was the Great Financial Crisis that exposed flaws in the GE model – it was too dependent on GE Capital, which was essentially a too-big-to-fail bank that had given management the leeway to smooth out earnings for years. The subsequent downfall of the company prompted many to reexamine Jack Welch’s legacy.

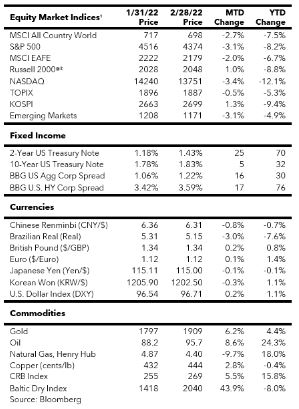

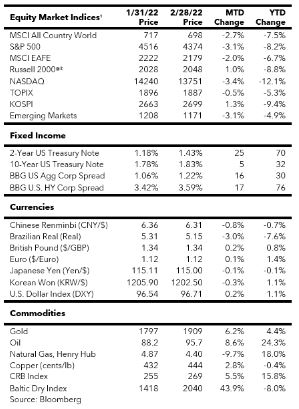

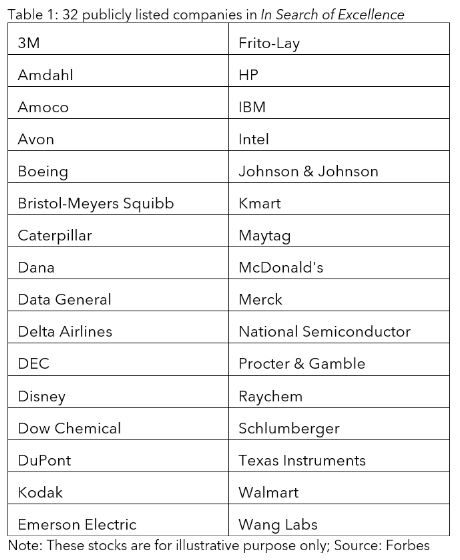

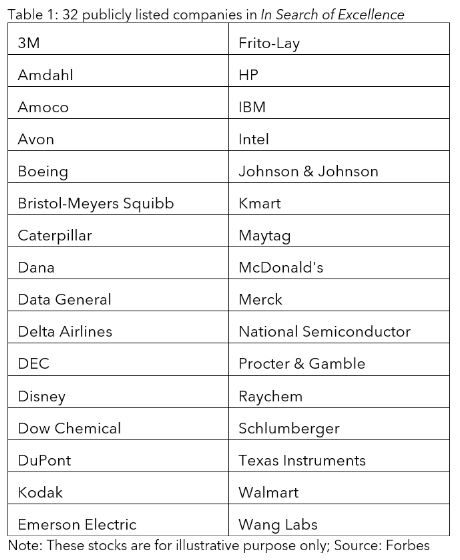

The fact that In Search of Excellence has remained a classic and that many of the companies cited for their “excellence” are still world-class institutions forty years later is testament to Peters and Waterman’s great insights. While some of the companies that they highlighted wound up as big disappointments – Kmart, Kodak, and Wang Labs went bankrupt – others have created tremendous value even four decades later. In 2002, on the twentieth anniversary of the book’s publication, Forbes found that the average annualized returns of the 32 publicly listed “excellent” companies (Table 1) was 14.1%, which handily exceeded the S&P 500 Index’s 10.1% annualized return during those two decades.

Today, nearly forty years after the book’s publication, 11 of the 32 companies still managed to outperform the S&P 500 Index while 9 were acquired and 12 had underperformed. Among the biggest winners, Disney, Walmart, and McDonald’s were not big enough in 1982 to make the Fortune 500 list. Intel and Texas Instruments remained atop their respective semiconductor markets by maintaining manufacturing and design leadership. The worst performers were all hurt by creative destruction. Kodak failed to branch into new businesses as digital photography decimated its highly lucrative film business. All the computer and hardware companies on the list – Amdahl, Data General, Digital Equipment, HP, IBM, and Wang Labs – were hurt by the rise of personal computing and the companies’ failure to build up a non-proprietary software business. I would conclude the following lessons from these developments:

- In the long run, active management can still beat passive investing by buying good businesses at reasonable valuations.

- Technology companies that create new or disrupt existing markets have strong growth potential, but they also run the risk of being victimized by creative destruction.

- Today’s largest market capitalization stocks will probably not be among the best performing stocks over the next ten years. The challenge is to find the next set of mid-size growth companies like Peters and Waterman did with Disney, Walmart, and McDonald’s in the early 1980s.

- Once an “excellent” company is identified by the market, investors would quickly bid up its valuation in anticipation of strong growth. However, as the company’s growth starts to mature, the stock could be stuck in a trading range for an extended period of time for earnings to catch up to valuation. In other words, it’s important to look at a stock’s life cycle and valuations.

A CENTURY OF SECULAR BULL/BEAR MARKETS

The publication of In Search of Excellence in 1982 coincided with the start of what turned out to be the longest running secular bull market in U.S. history – it spanned more than 17 years and evolved into the Dot-Com bubble that peaked in March 2000. With the benefit of hindsight, we now know that with inflation coming down and market P/E at merely 7 to 8 times, the risk-reward tradeoff in late 1982 was extremely attractive. It would have been great if someone had a crystal ball in 1982 to foretell the market cycle. Indeed, as a student of history, I find the study of market cycles and their turning points to be quite illuminating as it helps to put our present situation into proper perspective.

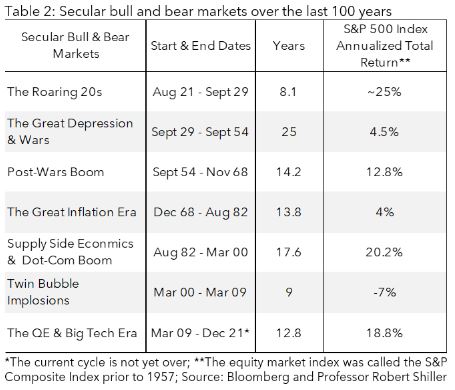

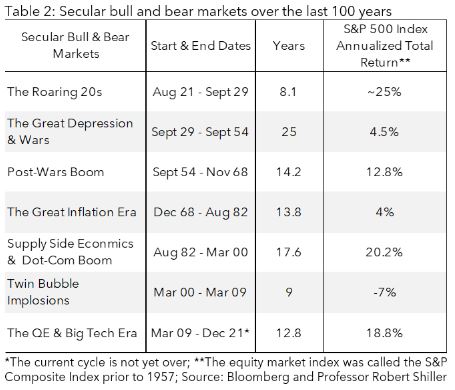

Over the last 100 years, there were six extended bull and bear markets driven by long waves of macro forces. Notwithstanding the brief but sharp bear market at the onset of the COVID-19 pandemic, we are still in the midst of a secular bull market that started in March 2009 (Table 2).

The epic bull market of the Roaring Twenties started in August 1921, when the economy was just emerging out of the Depression of 1920-21. Historians believed that the 1920-21 recession was caused by an inexperienced Fed that had only come into existence in early 1914. In reaction to the inflation triggered by WWI and the Spanish flu, which had risen as high as 24% by mid-1920, the Fed over-tightened and created a bout of deflation and economic contraction. The Fed’s subsequent loosening and President Warren Harding’s tax cuts in 1921 put the economy and the stock market back on the right course. Following Harding’s death in August 1923, his successor, Calvin Coolidge, pursued a conservative agenda – big tax cuts, light regulation, a balanced budget, and debt reduction – that turbocharged the economy and earnings.

In 1928, investor sentiment started to turn frothy, prompting the Fed to warn commercial banks to reduce lending to brokers that were making margin loans to investors. When the banks ignored the Fed’s moral suasion and direct warnings, the Fed started raising interest rates in August 1928. To its surprise, the stock market brushed off the rate hikes and went parabolic – from August 1928 to the cycle peak in September 1929, the Dow Jones Industrial Average Index (DJIA) surged 76% even though signs of economic slowdown were becoming apparent. Then, in late October 1929, the market’s bottom fell without much warning; the DJIA fell 48% from its September 3rd peak to the interim trough on November 13th. This massive drawdown sucked in many “buy-the-dip” investors who would later found out that it was a classic bear market trap.

The Crash of 1929 was more than what the Fed had intended, and the economy became the collateral damage. The Fed then made two critical errors that turned the recession into a depression – it failed to increase money supply when deflation set in, and its refusal to be the lender of last resort to some troubled banks led to bank runs and a collapse in confidence. The resulting secular bear market lasted a quarter century which spanned the Great Depression, World War II, and the Korean War. The S&P’s equity index had dropped as much as 86% from its September 1929 peak, and it finally reclaimed that peak in September 1954.

In January 1953, Dwight Eisenhower became the 34th President of the U.S. As a decorated general who understood the perils of war, he ended the Korean War in July of that year and pursued a policy of confronting communist encroachment while preserving peace. As the U.S. emerged from the post-Korean War recession in 1954 with a renewed animal spirit, a new secular bull market was born. This 14-year bull market from 1954 to 1968 coincided with what is considered the golden era of American economic supremacy. The economy benefited from highly productive infrastructure investments such as the construction of the Interstate Highway System, and our booming exports had no serious foreign rivals. During the 12-year period from 1954 through 1965, inflation never rose above 3.7% and was kept below 2% in 117 out of the 144 months, or 81% of the time. Unlike our current crop of central bankers, Fed officials at the time looked at sub-2% inflation as a sign of success. The government also brought down the national debt from 69% of GDP in 1954 to 39% by 1968.

This golden era ended with rising inflation in the late 1960s as a result of President Johnson’s guns and butter policy initiatives. In 1968, inflation rose above 4% for the first time in more than sixteen years, and years of balance of payment deficits led to a currency crisis. Speculators drove the price of gold from the official peg of $35 per ounce to more than $40, which forced Johnson to enlist Western European allies to jointly defend the greenback. The crisis compelled the Johnson Administration to raise taxes and led the Fed to tighten more aggressively. However, it was too late to put the inflation genie back into the bottle, and the U.S. would go on to suffer three big waves of inflation with higher peaks as well as higher troughs. Some historians believed that the problem was exacerbated by a Fed whose independence was compromised by intimidation from Johnson and Nixon.

The secular bear market during the Great Inflation era also reflected many deep-seated problems in the U.S. The once mighty U.S. export engine was sputtering in the face of competition from West Germany and Japan. President Nixon’s abrupt ending of the gold standard sent the greenback into a decade of devaluation; the U.S. Dollar Index (DXY) had weakened by as much as 34%. The national psyche was damaged by the OPEC oil embargo, the Watergate scandal, the fall of Saigon, and the Iranian hostage crisis. This humiliating era was finally ended by Fed Chair Paul Volcker’s draconian rate hikes that broke the back of inflation, and President Reagan’s MAGA policies which were derided by many at the time as “voodoo economics” and “war mongering.” (Note: “Let’s make America great again” was Ronald Reagan’s 1980 campaign slogan.)

The great secular bull market that started in 1982 was characterized by several trends that are still highly relevant 40 years later. One prominent trend remains the rise of equity culture. Prior to the 1990s, companies usually funded acquisitions with a combination of debt and internally generated cash, and executive compensation consisted of mostly salaries and cash bonuses. The raging bull market led corporate executives to start using stocks as a convenient currency for acquisition and compensation. M&As were increasingly financed by stock issuance, and stock options became a key part of pay packages, especially among startups. These developments made shareholder primacy – maximizing shareholder value above all else – the dominant corporate philosophy. Interestingly, the aforementioned Jack Welch and the GE Way were the epitomes of shareholder primacy.

The equity culture also took hold on Main Street as the growing ease of online trading and rapidly declining commissions gave rise to retail trading. By the late 1990s, it was common to see TVs in restaurants and hair salons tuned to CNBC.

Another emerging trend from that era was the growing perception of the so-called “Fed put”; that is, the belief among investors that the Fed would come to the market’s rescue should equities experience a sizeable pullback. This perception started with Fed Chair Greenspan’s proactive response to the 20%+ market crash on October 19, 1987. To avoid a repeat of the Fed’s mistakes in the aftermath of the Crash of 1929, Greenspan urged banks to increase lending to Wall Street and then cut the Fed funds rate several times even though the economy was red hot – real GDP grew at an annualized pace of 6.8% in the fourth quarter of 1987.

The “Fed put” did not come to the market’s rescue in 2000 when the Dot-Com bubble started to burst. While the NASDAQ Composite Index lost 39% that year, the S&P 500 Index was down only 10% as value stocks had a good year. However, on January 3, 2001, the Fed surprised the market with a 50-bps intermeeting rate cut. It was the start of an easing campaign that took the Fed funds rate from 6.5% down to 1% by mid-2003. Unfortunately, the bear market and the recession triggered by the collapse of the Dot-Com bubble were exacerbated by the September 11 attacks.

The Fed’s unprecedented 11 rate cuts in one year helped pull the U.S. economy out of the recession in late 2001. The low interest environment created a housing boom that eventually morphed into a giant subprime mortgage bubble, which many regulators, including the Fed, had viewed as containable. By mid-2007, the imploding subprime mortgage market had forced several lenders into bankruptcy. However, the S&P 500 Index kept on moving higher as investors were expecting the “Fed put” to come to the rescue. The Index briefly reclaimed its March 2000 peak in July, but then gave up 10% after BNP Paribas, France’s largest bank, froze three of its money market funds due to subprime debt issues. This incident finally pushed the Fed into action: a surprise intermeeting 50-bps cut in the discount rate in mid-August followed by a 50-bps cut in the Fed funds rate at the September FOMC meeting. Investors took these rate cuts as the greenlight for risk-on moves and sent the S&P 500 Index to a cycle high of 1565 in October 2007, 2.5% above the March 2000 high. It was all downhill from there and the S&P 500 Index would not close above 1565 again until March 28, 2013. All told, it took 13 years for the S&P 500 to decisively break above the Dot-Com era peak first reached in March 2000.

THE ERA OF EXPERIMENTAL MONETARY POLICIES

With the S&P 500 Index finally rising above the March 2000 peak for good in March 2013, one could argue that the secular bear market of the 2000s decade did not really end until that time. However, I believe the market trough on March 9, 2009 was a clear demarcation because of the sea change in the Fed’s policy response to the Great Financial Crisis (GFC).

By late 2008, Fed Chair Bernanke had pretty much exhausted the Fed’s conventional policy tools in fighting the Great Financial Crisis. In November 2008, the Fed crossed the policy Rubicon by initiating a large-scale asset purchase program, aka Quantitative Easing. The initial plan was to purchase $600 billion of GSE (government-sponsored enterprises) and mortgage-backed securities in its attempt to stabilize the market. In March 2009, the Fed upsized the QE program to $1.75 trillion, which included $300 billion of Treasury bonds. By the time the S&P 500 Index bottomed on March 9, 2009, the Fed had already expanded its balance sheet by $900 billion from the time of the collapse of Lehman Brothers six months earlier.

In June 2014, another policy Rubicon was crossed when the European Central Bank (ECB) adopted the negative interest rate policy (NIRP). The Bank of Japan (BOJ) entered the NIRP territory in January 2016, and eight months later, introduced a policy of Yield Curve Control (YCC) to cap short-term and long-term policy rates.

For much of the current secular bull market, these experimental, or hitherto unconventional monetary policies have provided lots of benefits with practically no side-effects. Financial conditions were kept extremely easy to support economic growth, and government debts were indirectly financed by QE programs. Some were concerned that these ultra-loose policies would lead to higher inflation, but it only showed up in financial asset prices for much of the last decade. Financial asset prices were further boosted by President Trump’s pro-cyclical policies that cut taxes, increased spending, and drove up budget deficits during the expansionary phase of the business cycle. However, despite these growth drivers, real GDP in the last decade, which had benefited from the rebound off a deep recession, was only 2.2% annualized. This subdued growth environment pushed investors into growth stocks at the expense of the value and cyclical parts of the market.

The current bull market was briefly interrupted by a sharp but brief cyclical bear market at the onset of the COVID-19 pandemic – the S&P 500 Index dropped 34% in less than 5 weeks and global financial markets had essentially seized up in March 2020. The Fed stepped in as the buyer of last resort and purchased nearly $3 trillion of assets in three months. It marked the start of the most accommodative policy era in decades – from mid-March 2020 to the end of 2021, the Fed’s balance sheet expanded by $4 trillion while the federal government piled up more than $6 trillion of debt to fund several rounds of fiscal stimulus. The economy and financial markets responded rather quickly – the recession lasted just 2 months, and the S&P 500 Index had more than doubled from its March 2020 nadir by the end of 2021.

Upon examining the long arc of market history and financial bubbles, it’s not hard to conclude that the last 18 months of extremely accommodative policies have created some of the biggest speculative bubbles in decades, if not in centuries. I am not old enough to remember the froth in the late 1920s, but the frenzy for the so-called disruptive innovator stocks from the mid-2020 to early 2021 was reminiscent of the Dot-Com bubble. The meme stock craze that sent the share prices of companies known for deteriorating fundamentals to the moon was unprecedented. The pace of appreciation in home prices in 2021 made the mid-2000s housing bubble look staid, and some are now touting virtual property investment in the metaverse. To top it all off, the potent cocktail of easy money, hope, greed, innovation, and distrust in fiat money has led many to dive headlong into the unregulated realm of cryptocurrencies and NFTs.

Some have sought to justify the rapidly rising asset prices by pointing to exceedingly low nominal and still negative real interest rates. Central banks were conspicuously complicit in fueling the bubbles with continued QE in the face of rising inflation. Its ill-advised attempt to stoke inflation finally backfired – U.S. inflation, as measured by the CPI, surged to a 40-year high of 7.5% in January 2022. According to Shadowstats.com, the CPI in January would be above 15% if it were measured by the same methodology that the government used in 1980. It implies that, on an apples-to-apples basis, today’s inflation has topped the 14.8% peak of the Great Inflation era. The problem for our current QE-fueled secular bull market is that, should inflation become entrenched, the “Fed put” that investors have become so addicted to may have to be taken off the table for a while, and the Fed might have to engineer a harder economic landing to get inflation under control.

THE FED’S CATCH-22

Both the elevated equity market volatility and correction since the start of 2022 reflect the rapidly shifting macro backdrop and declining strike price for the “Fed put” (i.e., equities may have to decline a lot before the Fed intervenes to save the day). So far, equity movements look similar to the early phase of the post-Dot-Com market. Using the ARK Innovation ETF as a proxy for the growthier part of the market, much of the froth has dissipated as the ETF has dropped 55% from its February 2021 peak. However, value-oriented sectors have held up well, with some still having positive returns year-to-date in 2022.

How much longer the current secular bull market, which has benefitted from unprecedented monetary and fiscal stimuli as well as the biggest corporate tax cut in history, can go on largely depends on the Fed. It’s a delicate balancing act between fighting inflation and maintaining economic growth, and the Fed has a somewhat checkered history with it. The Fed’s tight money policy in the early 1930s let a recession fester into the Great Depression and a 25-year secular bear market. The Fed’s tacit tolerance of higher inflation in the late 1960s gave rise to the Great Inflation. The Fed’s ineffective oversight of the subprime mortgage market paved the way for the Great Financial Crisis and prolonged the secular bear market in the 2000s. Today, investors appear to be worried that the Fed would overreact to inflation and kill off the economic expansion and the bull market in the process. That concern is aptly reflected in the rapidly flattening yield curve.

Hope springs eternal. It is widely recognized that, starting in the spring, the base effect will cause the year-over-year inflation to moderate. One can make a plausible case that decelerating inflation and geopolitical uncertainties will allow the Fed to signal a more measured pace of tightening after frontloading some hikes in the spring to brandish its inflation fighting credentials. By the second half of 2022, a potentially less hawkish tightening campaign relative to what the market has discounted will likely be spun as an “easing” move to rekindle investors’ appetite for risk assets.

There is, however, the risk that if the Fed is half-hearted about taming inflation, the CPI could settle at levels well above the 2% to 2.5% target range. By late 2022 or early 2023, the Fed may find itself in an uncomfortable position of having to deal with still elevated inflation and below-trend growth prospects. How will the Fed deal with such a “stagflationary” environment?

The normalization process from a period of exceedingly accommodative monetary and fiscal stimuli is not going to be easy. With inflation now forcing the Fed to embark on a potentially aggressive tightening cycle, the odds of the Fed breaking something – the market, the economy, or both – are rising. The 13-year-old secular bull market is now facing an existential threat, though its eventual passing will likely entail a recession as a precondition, which does not appear to be imminent. One lesson I learned from the companies featured in In Search of Excellence is that quality companies in promising industries have the resiliency to generate good returns in the long run. Market selloffs in the first two months of 2022 appeared to have created attractive buying opportunities for the stocks of some great companies. Investors also have more options to deal with a difficult market than they did in the 1970s. For example, long-short equities strategies can go on the offense through shorting during difficult times. In summary, we cannot alter the course of the Fed’s actions and its impact on the market and the economy, but we can adjust our portfolios as the macro environment evolves.