With us, you will find a vast network of access, relationships, and opportunities well worth exploring.

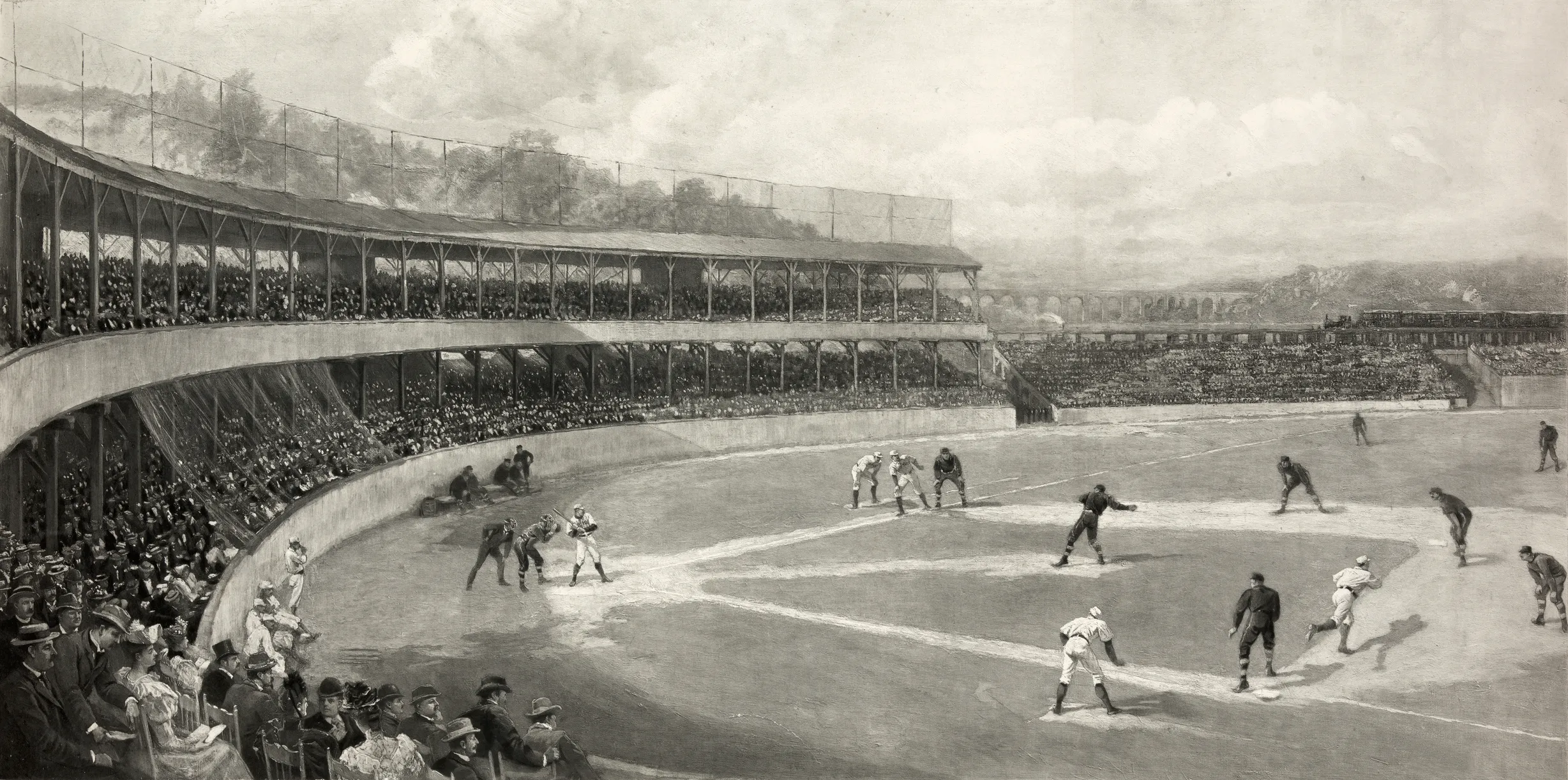

The Rockefeller name is synonymous with generational success, but that didn't happen overnight. As their wealth grew, they found themselves facing new challenges and greater opportunities that required a new kind of financial service and guidance.

More than 140 years later, we saw another opportunity: to create simplicity and freedom as trusted advisors to clients navigating the complexities of families and wealth. The Rockefeller Global Family Office was born.

Today, we tailor our services to each client and to the dynamic way their needs unfold as their live change.

Solutions Tailored to You

We provide a full breadth of financial services, with the personalized approach that your circumstances require.

Explore SolutionsUncommon Opportunities

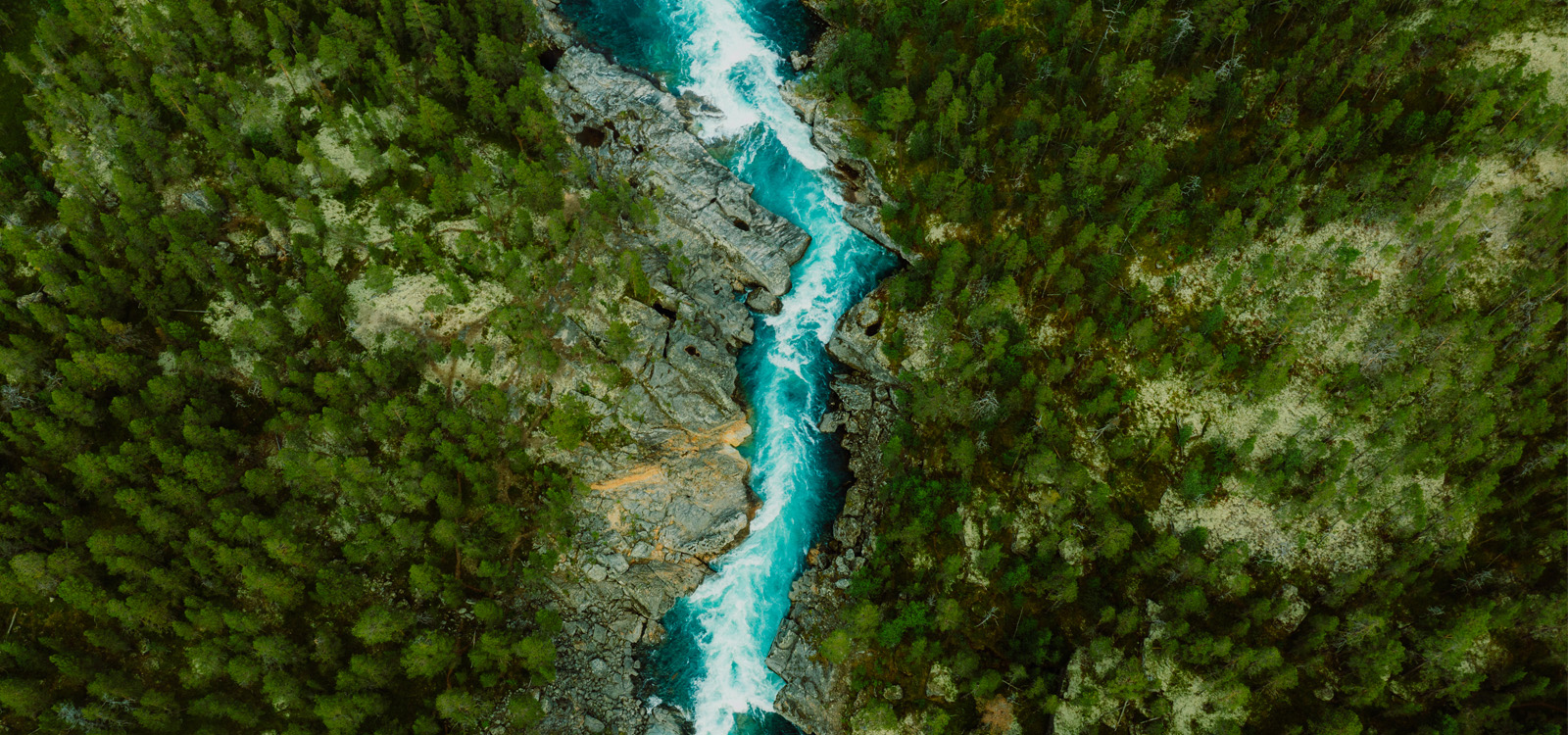

Our vast network connects you to opportunities not commonly found elsewhere.

Explore OpportunitiesThe Rockefeller Experience

We provide resources, technology and connections that help to put you in a league of your own.

Explore the ExperienceWe can help you put your wealth into action.

Investing involves risk, including risk of loss. Rockefeller Capital Management is the marketing name of Rockefeller Capital Management L.P. and its affiliates. Investment advisory, asset management and fiduciary activities are performed by the following affiliates of Rockefeller Capital Management: Rockefeller & Co. LLC, Rockefeller Trust Company, N.A., The Rockefeller Trust Company (Delaware) and Rockefeller Financial LLC, as the case may be. Rockefeller Financial LLC is a broker-dealer and investment adviser dually registered with the U.S. Securities and Exchange Commission (SEC); Member Financial Industry Regulatory Authority (FINRA), Securities Investor Protection Corporation (SIPC). These registrations and memberships in no way imply that the SEC has endorsed the entities, products or services discussed herein. Additional information is available upon request.